How Long Should a Financial Forecast Be?

In the world of business strategy, financial forecasting acts as our guiding light. It provides a roadmap for decision-making, helping us navigate the complex landscape of entrepreneurship. However, an important question emerges: How long should a financial forecast actually be?

While the accuracy and depth of a financial forecast are essential, the forecast’s duration holds its own significance. This post explores how to determine the ideal forecast length. We’ll explore factors ranging from industry dynamics to business aspirations, offering insights to help startups make swift decisions and established business plans for lasting growth. Join us as we unravel the mystery of forecast length and equip you to make strategic financial decisions.

What is the ideal forecast length?

There isn’t a one-size-fits-all answer when it comes to forecast lengths, as the optimal forecast duration varies based on factors unique to each business. The journey to determine the ideal forecast length involves a careful evaluation of your industry, business goals, and the purpose of the forecast itself.

Short-term forecasts, typically spanning one to two years, are well-suited for businesses seeking to navigate immediate operational decisions. These forecasts provide a clear picture of the near future. On the other hand, long-term forecasts, covering three years or more, cater to businesses with strategic aspirations. They assist in charting a course for growth, attracting investors, and aligning with broader business visions.

The key lies in aligning forecast length with your business’s unique characteristics and objectives. A startup aiming for rapid adaptation might prioritize short-term forecasts, while an established enterprise planning expansion might opt for a longer view. Ultimately, the ideal forecast length isn’t a fixed parameter but rather a dynamic choice that moulds itself to your business’s ever-evolving trajectory.

What factors influence forecast length?

The determination of the appropriate forecast length is influenced by a multitude of factors that collectively shape the financial roadmap for your business. While there’s no universal formula, understanding these influencing factors can aid in making an informed decision about the duration of your financial forecast.

- Industry dynamics: Different industries exhibit varying levels of volatility and change. High-paced sectors may require shorter forecast horizons to account for rapid shifts, while stable industries might benefit from longer-term projections.

- Business stage: The life stage of your business matters. Startups may lean towards shorter forecasts to adapt swiftly, whereas established businesses might focus on longer-term plans for sustained growth.

- Strategic goals: The nature of your business objectives plays a vital role. Short-term goals demand short-term forecasts, while long-term ambitions necessitate more extended projections.

- Market trends: Analyzing market trends and economic cycles helps decide whether to forecast for a shorter period to capitalize on immediate opportunities or for a longer span to account for potential economic shifts.

- Investor relations: If your business seeks external funding, investors often look for long-term projections to assess the company’s viability and growth potential.

- Minimize risk: Businesses operating in uncertain environments may benefit from shorter forecasts to minimize risk, while those in stable markets might focus on long-range planning.

- Regulatory requirements: Some industries have regulatory requirements dictating forecast length. Compliance considerations should influence your choice.

It’s the interplay of these factors that guides the decision on the forecast length, illustrating the importance of tailoring your financial forecast to suit your unique business landscape.

Common lengths of financial forecasts

Financial forecasts come in various lengths, each serving different purposes based on the needs of a business. While there’s no one-size-fits-all answer, here are some common lengths of financial forecasts along with their typical timeframes:

- Short-term forecasts: These forecasts typically cover a period of 1 to 2 years, and can be even shorter when considering 13 week forecasts. They focus on immediate decisions and allow you to adjust strategies in the near term.

- Medium-term forecasts: Medium-term forecasts usually extend from 2 to 3 years. These forecasts strike a balance between short-term agility and long-term planning, providing insights into mid-range goals and strategies.

- Long-term forecasts: Long-term forecasts encompass a period of 3 years or more. They are geared towards strategic planning, growth projections, and attracting long-term investors

- Multi-year forecasts: These forecasts span 5 years or more, providing a comprehensive view of a business’s financial performance and growth potential over a more extended period. They are often used for strategic decision-making and are common when seeking long-term funding or partnerships.

- Annual forecasts: These are short-term forecasts covering a single year. They are common for budgeting purposes and for setting annual performance goals.

- Quarterly forecasts: These forecasts break down the year into quarters, providing insights into a business’s financial performance and trends throughout the year. They are often used for tracking progress against goals and making adjustments in real-time.

- Rolling forecasts: Rolling forecasts are continuously updated financial projections that extend into the future. As time progresses, the forecast is adjusted by adding another period (e.g., month, quarter) to the end, ensuring that the forecast is always looking ahead.

Remember that the appropriate length of a financial forecast depends on your business’s industry, stage, goals, and the level of uncertainty in the market. It’s common for businesses to use a combination of forecast lengths to cater to different aspects of decision-making and planning.

Short-term vs. long-term forecasts

One of the critical decisions you’ll face with forecasting is whether to opt for a short-term or a long-term forecast. Understanding the key factors is essential to craft a forecast that best serves your business needs.

Short-term forecasts

Pros

- Ease of use and responsiveness: Short-term forecasts excel at adapting to rapidly changing market conditions. This agility is vital for businesses seeking to seize immediate opportunities or navigate sudden challenges.

- Operational planning: Short-term forecasts are valuable for day-to-day operational decisions, helping businesses allocate resources efficiently based on current trends.

- Data accuracy: As the forecast horizon is shorter, it’s often easier to gather accurate data for the period, enhancing the reliability of projections.

Cons

- Limited long-term strategy: Short-term forecasts may not capture long-range trends or strategic opportunities, potentially leading to missed growth prospects.

- Risk of overreacting: Businesses relying solely on short-term forecasts might be prone to making knee-jerk decisions based on temporary fluctuations.

- Investor perception: While short-term forecasts are great for internal operations, they might not provide the depth investors seek when evaluating long-term prospects.

Long-term forecasts

Pros

- Strategic planning: Long-term forecasts, spanning three years or more, allow for comprehensive strategic planning. Businesses can align their growth trajectories and long-range goals more effectively.

- Investor attraction: When seeking external funding, detailed long-term forecasts provide investors with a holistic view of your business’s potential, fostering trust and confidence.

- Risk mitigation: By accounting for extended market cycles, long-term forecasts enable businesses to plan for potential downturns and adapt accordingly.

Cons

- Limited adaptability: Long-term forecasts might struggle to accommodate sudden shifts or unforeseen market changes due to their extended time horizon.

- Data complexity: Gathering accurate data for longer periods can be challenging, potentially affecting the precision of projections.

- Resource allocation challenges: Long-term forecasts might lead to resource allocation decisions that later prove suboptimal due to unforeseen circumstances.

Many successful businesses employ a combination of both approaches, using short-term forecasts for immediate decision-making and long-term forecasts to set the course for sustained growth. By carefully evaluating the pros and cons of each option, you can strike the right balance that aligns with your business strategy and vision.

Should you tailor forecasts to business goals

It’s really important to make sure your predictions match up with what your business is trying to achieve. This means tailoring your forecasts to fit your specific goals. When you do this, you get insights that directly help you make better decisions. For example, if a company wants to manage their products in stores better, they can use forecasts that take into account when people usually buy things and how much they buy. This helps the business balance having enough products without wasting money on too much inventory. Matching forecasts to business goals helps companies deal with challenges and stay focused on what they want to achieve.

On the other hand, if forecasts don’t match up with business goals, they might not be very useful. Generic forecasts that aren’t connected to what a company is trying to do can overwhelm decision-makers with too much information. This can make it hard to figure out what’s important and what’s not. When forecasts aren’t aligned with what a company wants to achieve, they might also miss out on chances to grow and improve. For instance, a new tech company that wants investors to support them would need forecasts that show how many people are using their product and liking it. If their forecasts don’t show this clearly, they might struggle to get the investment they need. So, aligning forecasts with business goals is like having a map that guides a company through challenges and uncertainties.

Test forecast lengths in a tool like Brixx

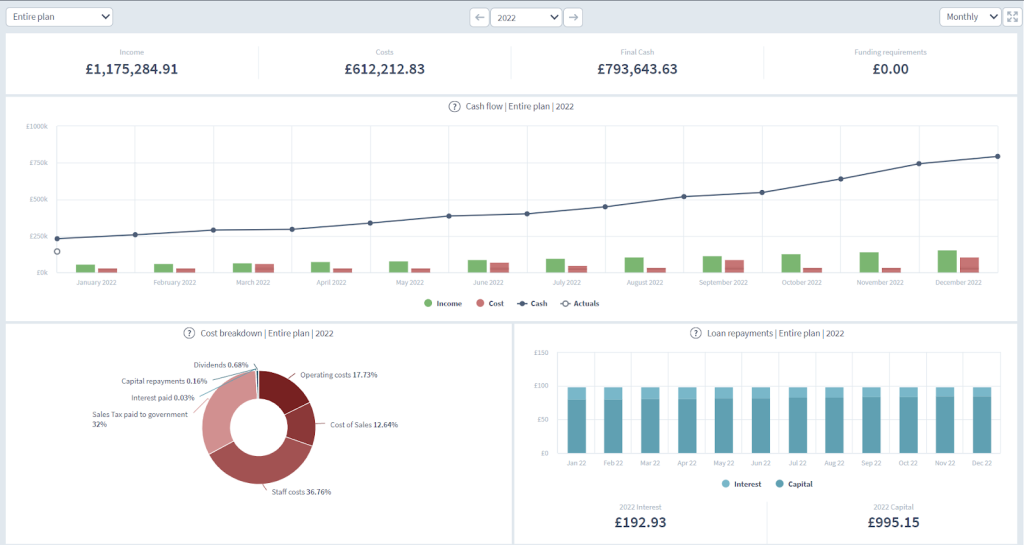

Using financial forecasting software like Brixx can be incredibly beneficial for testing different forecast lengths. Brixx is designed to help businesses create accurate financial forecasts, model scenarios, and assess the impact of various decisions.

Here’s how you can test forecast lengths using Brixx:

- Sign up or log in: If you don’t have a Brixx account, sign up for one. If you already have an account, log in to your Brixx dashboard.

- Create a new forecast: Start by creating a new forecast. Provide the necessary details about your business, such as the industry, business type, and the time period you want to forecast.

- Choose forecast length: In Brixx, you can usually set the forecast length when you’re setting up your forecast. Choose the appropriate forecast duration based on your testing needs. For instance, you can set up short-term forecasts (1-2 years), medium-term forecasts (2-3 years), or long-term forecasts (3+ years).

- Input data: Input your business’s financial data. Ensure that the data you input is accurate and reflective of your business’s current and future operations.

- Scenario testing: As a scenario analysis tool, Brixx allows you to create different scenarios by tweaking variables and assumptions. Use scenario testing to see the impact of forecast length by creating scenarios with varying time horizons. For example, you can compare scenarios with short-term and long-term forecasts to see how they affect your financial projections.

- Analyze results: Brixx will generate visualizations and reports based on your input data and scenarios. Analyze the results to see how different forecast lengths influence your financial outcomes. Look for patterns, trends, and differences in the projections.

- Iterate and refine: Based on your analysis, you can refine your forecast length and assumptions. Test different scenarios to find the forecast length that aligns best with your business goals and strategies.

- Review business goals: Always keep your business goals in mind as you analyze the results. The forecast length that best supports your objectives, whether short-term tactical decisions or long-term strategic growth, is the one you should focus on.

Remember that financial forecasts are a dynamic tool, and testing different forecast lengths can help you make more informed decisions. Utilizing tools like Brixx empowers you to create accurate and customized forecasts that align with your unique business needs.